UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.

| Filed by the Registrant | x |

| Filed by a Party other than the Registrant | o |

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

IEC Electronics Corp.

(Name of Registrant as Specified inIn Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction | |

| applies: |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| Fee paid previously | with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No. | : |

| (3) | Filing Party: |

| (4) | Date Filed: |

IEC ELECTRONICS CORP.

105 NORTON STREET

NEWARK, NEW YORK 14513

(315)331-7742

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On

Dear Stockholder:

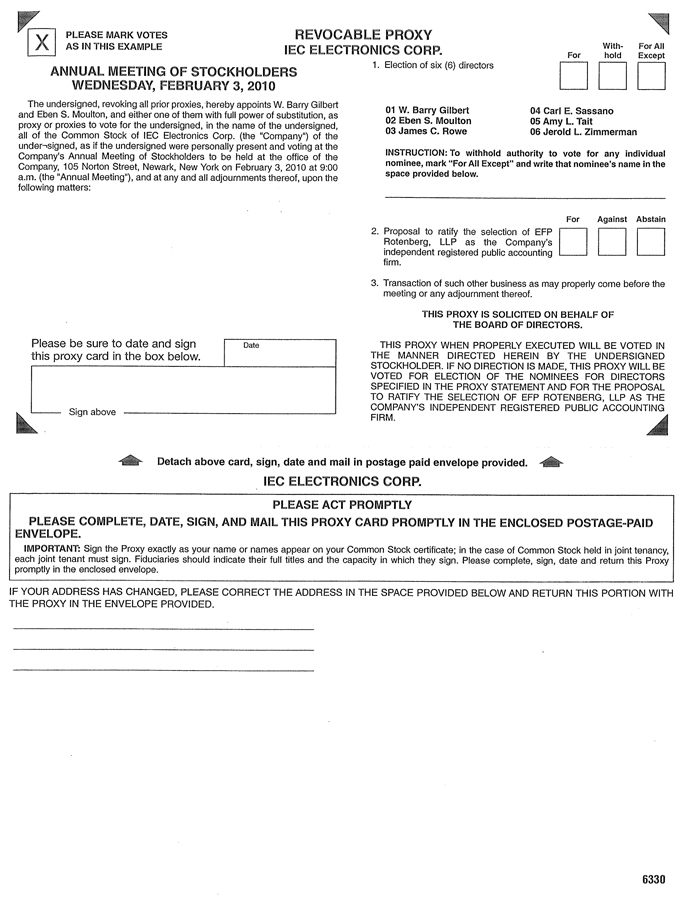

You are cordially invited to attend the annual meeting of stockholders ofIEC Electronics Corp.The meeting will be held on Wednesday, February 3, 2010January 30, 2013 at 9:00 a.m. (local time) at our offices, 105 Norton Street, Newark, New York, for the following purposes:

| 1. | To elect six (6) directors to serve until the |

| 2. | To ratify the selection of EFP Rotenberg, LLP as the independent registered public accounting firm of the Company for the fiscal year ending September 30, |

| 3. | To approve, on a non-binding advisory basis, the compensation paid to our named executive officers. |

| 4. | To vote, on a non-binding advisory basis, on the frequency of future advisory votes on named executive officer compensation. |

| 5. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

The record date for the annual meeting is December 17, 2009.10, 2012. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof. Our transfer books will not be closed

By Order of the Board of Directors

Beth Ela Wilkens,

| December Newark, New York |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON FEBRUARY 3, 2010.

Our proxy statement and Annual Report to Stockholders, which are enclosed with this mailing, are also available online, at https://materials.proxyvote.com/44949L.

IEC ELECTRONICS CORP.

105 NORTON STREET

NEWARK, NEW YORK 14513

(315)331-7742

PROXY STATEMENT

FOR

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We are sending you this proxy statement and the enclosed proxy card because the board of directors of IEC Electronics Corp. (“IEC”, the “Company”, “we”, “our”, “us”) is soliciting your proxy to vote at the 20102013 Annual Meeting of Stockholders.Stockholders and any adjournment or postponement thereof. We invite you to attend the annual meeting and request that you vote on the proposals described in this proxy statement. The meeting will be held on Wednesday, February 3, 2010January 30, 2013 at 99:00 a.m. (local time) at our office, 105 Norton Street, Newark, New York. To obtain directions to be able to attend the Annual Meeting and vote in person, please contact our Corporate Secretary, Beth Ela Wilkens, at (585) 419-8645. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, date, sign and return the enclosed proxy card.

We are mailing this proxy statement, the accompanying proxy card, and our Annual Report to Stockholders for the fiscal year ending September 30, 20092012 (“Fiscal 2009”2012”) on or about December 29, 200921, 2012 to all stockholders of record entitled to vote at the annual meeting.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on December 17, 2009,10, 2012, the record date for the meeting, will be entitled to vote at the annual meeting. On December 17, 2009,10, 2012, there were 8,818,55711,026,587 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on December 17 2009,10, 2012, your shares of IEC common stock were registered directly in your name with our transfer agent, Registrar and Transfer Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on December 17, 2009,10, 2012, your shares of IEC common stock were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a signed letter or other valid proxy from your broker or other agent.

What am I voting on?

There are twofour matters scheduled for a vote: (1) the election of six directors to serve until the 20112014 Annual Meeting of Stockholders, and(2) the ratification of the selection of EFP Rotenberg, LLP as our independent registered public accounting firm for the fiscal year ending September 30, 2010.2013, (3) an advisory vote to approve the compensation paid to our named executive officers, and (4) an advisory vote to select the frequency of future advisory votes on named executive officer compensation. Our board of directors does not intend to bring any other matters before the meeting and is not aware of anyone else who will submit any other matters to be voted on. However, if any other matters properly come before the meeting, the people named on the proxy card, or their substitutes, will be authorized to vote on those matters in their own judgment.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you owned as of December 17, 2009.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares entitled to vote are present at the meeting. Your shares are counted as present at the meeting if:

You have properly submitted a proxy card.

Your shares will be counted towards the quorum only if you submit a valid proxy or vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, a majority of the votes present at the meeting may adjourn the meeting to another date.

How do I vote?

The procedures for voting are set forth below:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting or vote by proxy using the enclosed proxy card. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person if you have already voted by proxy.

To vote using the proxy card, simply complete, date and sign the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you hold your shares in “street name” and thus are a beneficial owner of shares registered in the name of your broker, bank or other agent, you must vote your shares in the manner prescribed by your broker or other nominee. Your broker or other nominee has enclosed or otherwise provided a voting instruction card for you to use in directing the broker or nominee how to vote your shares. Check the voting form used by that organization to see if it offers internet or telephone voting. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

How are votes counted?

You may either vote “FOR” or “WITHHOLD” authority to vote for each nominee for the board of directors.directors in Proposal 1. You may vote “FOR”, “AGAINST” or “ABSTAIN” on any other proposals.

If you submit your proxy but abstain from voting or withhold authority to vote on one ofor more matters, your shares will be counted as present at the meeting for the purpose of determining a quorum. Your shares also will be counted as present at the meeting for the purpose of calculating the vote on the particular matter with respect to which you abstained from voting or withheld authority to vote.

Under the rules of The New York Stock Exchange ("NYSE"(“NYSE”), if you hold your shares in street name and do not provide voting instructions to your brokerage firm, it may still be able to vote your shares with respect to certain "discretionary"“discretionary” (or routine) items, but it will not be allowed to vote your shares with respect to

certain "non-discretionary"“non-discretionary” items. In the case of non-discretionary items, for which no instructions are received, the shares will be treated as "broker non-votes"“broker non-votes”. Shares that constitute broker non-votes will be counted as present at the meeting for the purpose of determining a quorum, but will not be considered entitled to vote on the proposal in question. We believe that effective January 1, 2010, aA broker will not have discretionary authority to vote shares for the election of directors but will have discretionary authority to vote on the proposalProposal 2 relating to the ratification of the selection of theour independent accounting firm.firm, but will not have discretionary authority to vote on any other matter. As a result, if you do not vote your street name shares, your broker has the authority to vote on your behalf with respect to Proposal 2 (the ratification of the selection of the accounting firm), but not with respect to Proposal 1 (the election of directors), Proposal 3 (advisory vote to approve the compensation paid to our named executive officers) and Proposal 4 (selection of the frequency of future advisory votes on named executive officer compensation). We encourage you to provide instructions to your broker to vote your shares foron Proposals 1, 3 and 4.

An inspector of election appointed by the director nominees.

How many votes are needed to approve each Proposal?

Proposal 1 directors; |

and

| • | Proposal 4 — Advisory vote on the frequency of future votes on named executive officer compensation: |

The outcome of each of these votes will be determined by a plurality of the votes represented by the shares of common stock present at the meeting in person or by proxy.

Proposal 2 2013; |

and

| • | Proposal 3 — Advisory vote on the compensation paid to our named executive officers: |

Approval is byfor each of Proposals 2 and 3 requires the affirmative vote of a majority of the shares present in person or by proxy at the meeting and entitled to vote. Abstentions are counted and have the effect of a vote against the proposal, because abstentions are deemed to be present and entitled to vote but are not counted toward the affirmative vote required to approve such proposal. Broker non-votes will not be considered as present and entitled to vote on the proposal. Therefore, under applicable Delaware law, broker non-votes will have no effect on the number of affirmative votes required to adopt such proposal.

What if I return a proxy card but do not make specific choices? What are the recommendations of our board of directors?

If you return a signed and dated proxy card without marking any voting selections, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the board of directors. The board'sboard’s recommendation is set forth together with the description of each proposal in this proxy statement. In summary, the board recommends a vote:

for election of all of the nominated |

for ratification of EFP Rotenberg, LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, ; |

| • | for approval of the compensation paid to our named executive officers (see Proposal 3); and |

| • | for advisory votes on named executive officer compensation every year (see Proposal 4). |

With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the board of directors or, if no recommendation is given, in their own discretion.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are a stockholder of record, you may revoke your proxy in any one of three ways:

You may send a written notice that you are revoking your proxy to: Corporate Secretary, IEC Electronics Corp., 105 Norton Street, Newark, NY 14513.

If you hold your shares in street name, contact your broker or other nominee regarding how to revoke your proxy and change your vote.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in our quarterly report ona Form 10-Q for8-K to be filed with the second quarter ending March 26, 2010.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, date, sign and return each proxy card to ensure that all of your shares are voted.

Who is paying for this proxy solicitation?

IEC will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors, officers and employees may also solicit proxies in person, by telephone, or by other means of communication. We will not pay our directors, officers and employees any additional compensation for soliciting proxies. In addition, we have retained the firm of InvestorCom, Inc., a professional solicitation firm, to assist us in the distribution and solicitation of proxies, for a fee of $2,500,$4,500, plus expenses. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

When are stockholder proposals due for next year’s annual meeting?

At our annual meeting each year, our board of directors submits to stockholders its nominees for election as directors. In addition, the board of directors may submit other matters to the stockholders for action at the annual meeting.

Our stockholders also may submit proposals for inclusion in the proxy material. These proposals must meet the stockholder eligibility and other requirements of the Securities and Exchange Commission (the “Commission”).SEC. To be considered for inclusion in next year’s proxy materials, you must submit your proposal in writing by August 30, 201023, 2013 to our Corporate Secretary, IEC Electronics Corp., 105 Norton Street, Newark, NYNew York 14513.

In addition, our by-laws provide that a stockholder may present from the floor a proposal that is not included in the proxy statement if the stockholder delivers written notice to our Corporate Secretary not less than 90 days prior to the date of the meeting. The notice must set forth your name, address and number of shares of stock you hold, a representation that you intend to appear in person or by proxy at the meeting to make the proposal, a description of the business to be brought before the meeting, the reasons for conducting such business at the annual meeting, any material interest you have in the proposal, and such other information regarding the proposal as would be required to be included in a proxy statement. We have received no such notice for the 20102013 annual meeting. For the 20112014 annual meeting of stockholders, written notice must be delivered to our Corporate Secretary at our principal office, 105 Norton Street, Newark, NYNew York 14513, no later than November 5, 2010.

Our by-laws also provide that if a stockholder intends to nominate a candidate for election as a director, the stockholder must deliver written notice of such intent to our Corporate Secretary. The notice must be delivered not less than 90 days before the date of a meeting of stockholders. The notice must set forth your

name and address and number of shares of stock you own, the name and address of the person to be nominated, a representation that you intend to appear in person or by proxy at the meeting to nominate the person specified in the notice, a description of all arrangements or understandings between such stockholder and each nominee and any other person (naming such person) pursuant to which the nomination is to be made by such stockholder, the nominee’s business address and experience during the past five years, any other directorships held by the nominee, the nominee'snominee’s involvement in certain legal proceedings during the past fiveten years and such other information concerning the nominee as would be required to be included in a proxy statement soliciting proxies for the election of the nominee. In addition, the notice must include the consent of the nominee to serve as a director if elected. We have received no such notice for the 20102013 annual meeting. For the 20112014 annual meeting of stockholders, written notice must be delivered to our Corporate Secretary at our principal office, 105 Norton Street, Newark, NYNew York 14513 no later than November 5, 2010.October 31, 2013.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table showsindicates the amount of IEC’s common stock beneficially owned as of December 17, 200910, 2012 by (i) each person who is known by us to beneficially own more than 5% of our common stock, (ii) each of our directors, (iii) each of our executive officers named in the Summary Compensation Table, and (iv) all of our directors and executive officers as a group. The information as to each person has been furnished by such person, and, except as noted, each person named in the table has sole voting and investment power with respect to the shares of common stock indicated as beneficially owned.

| Name of Beneficial Owner | Shares Beneficially Owned(1) | Percent of Shares Beneficially Owned(1) | ||||||

| Directors | ||||||||

| W. Barry Gilbert* | 453,608 | (2) | 4.11 | % | ||||

| Florence D. Hudson | 313 | † | ||||||

| Edward W. Kay, Jr. | 146 | † | ||||||

| Eben S. Moulton | 340,582 | (3) | 3.09 | % | ||||

| James C. Rowe | 264,437 | (4) | 2.40 | % | ||||

| Amy L. Tait | 71,342 | (3) | † | |||||

| Jerold L. Zimmerman | 116,183 | (5) | 1.05 | % | ||||

| Executive Officers | ||||||||

| Donald S. Doody | 233,391 | (6) | 2.12 | % | ||||

| Vincent A. Leo | 20,000 | (7) | † | |||||

| Jeffrey T. Schlarbaum | 349,575 | (8) | 3.17 | % | ||||

| All directors and executive officers as a group (10 persons) | 1,849,577 | 16.77 | % | |||||

| Shares | Percent of Shares | |||||||

| Name of | Beneficially | Beneficially | ||||||

| Beneficial Owner | Owned(1) | Owned(1) | ||||||

| Directors | ||||||||

| W. Barry Gilbert* | 367,001 | (2) | 4.15 | % | ||||

| Eben S. Moulton | 308,081 | (3) | 3.49 | % | ||||

| James C. Rowe | 252,053 | (4) | 2.86 | % | ||||

| Carl E. Sassano | 43,175 | (5) | + | |||||

| Amy L. Tait | 13,983 | + | ||||||

| Jerold L. Zimmerman | 100,519 | (6) | 1.14 | % | ||||

| Executive Officers | ||||||||

| Donald S. Doody | 143,000 | (7) | 1.62 | % | ||||

| Jeffrey T. Schlarbaum | 167,000 | (8) | 1.88 | % | ||||

| Michael R. Schlehr | 20,761 | (9) | + | |||||

| All directors and executive officers as a group (9 persons) | 1,415,573 | (10) | 15.83 | % | ||||

| * | Mr. Gilbert is also an executive officer. |

| † | Indicates beneficial ownership of less than one percent. |

| (1) | The number and percentage of shares beneficially owned are based on |

| (2) | Includes |

| (3) | Includes |

| (4) | Includes |

| (5) |

| Includes 45,000 shares owned by |

| Includes |

| (7) | Consists entirely of shares of restricted stock. Mr. Leo’s services as Chief Financial Officer are provided pursuant to an agreement between the Company and Insero & Company CPAs, P.C. (“Insero”), as more fully described below under “Certain Relationships and Related Person Transactions.” We have been advised that Mr. Leo holds such shares for the benefit of Insero. |

| (8) | Includes 17,000 shares held by Mr. Schlarbaum’s wife in her 401(k) plan, |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, and persons who own more than 10% of a registered class of our equity securities, to file with the CommissionSEC reports of ownership and changes in ownership of our common stock and our other equity securities. Officers, directors and greater than 10% stockholders are required by CommissionSEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

SEC regulations require the Company to identify any oneeach person who filed a required report late during the most recent fiscal year. Based solely on review of the copies of such reports furnished to the Company and written representations that no other reports were required during the fiscal year ended September 30, 2009,2012, we believe that, during Fiscal 2009,2012, all of our directors and executive officers complied with the reporting requirements of Section 16(a), except for Mr. Sassano, who filed one late report disclosing one transaction and Mr. Zimmerman who filed two late reports each disclosing one transaction..

(ProposalPROPOSAL 1)

ELECTION OF DIRECTORS

The number of directors is established by the board and is currently fixed at seven. At this annual meeting, six persons will be nominated as directors. AllFour of the nominees for director except for Amy L. Tait, were elected at the last annual meeting. Mrs. Tait wasFlorence D. Hudson and Edward W. Kay, Jr. were elected byto the board onin August 18, 20092012 and November 2012, respectively, to fill a vacancyvacancies on the board and Mrs.board. Amy L. Tait is being nominateddeclined to seek reelection as a director. The term of office of each person elected as a director for election bywill continue until the stockholders fornext annual meeting or until his or her successor has been elected and qualified, or until the first time at this annual meeting.

Following the 2013 annual meeting, there will remain one vacancy on the board. The board intends to consider potential candidates to fill the vacancy and, accordingly, has not taken any action to reduce the size of the board.

All nominees have consented to serve if elected. We expect that each of the nominees will be available for election, but if any of them is not a candidate at the time the election occurs, it is intended that such proxy will be voted for the election of another nominee to be designated by the board to fill any such vacancy.

Required Vote

For the election of directors, only proxies and ballots marked "FOR“FOR all nominees"nominees”, "WITHHELD“WITHHELD for all nominees"nominees” or specifying that votes be withheld for one or more designated nominees are counted to determine the total number of votes cast; votes that are withheld are excluded entirely from the vote and will have no effect. Abstentions will have no effect on the vote for the election of directors. Directors are elected by a plurality of the votes cast. This means that the six nominees identified below will be elected if they receive more affirmative votes than any other nominees.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTEFOR THE ELECTION AS DIRECTORS OF EACH OF THE NOMINEES LISTED BELOW.

Nominees for Election as Directors

The namesfollowing table sets forth each director nominee and includes such person’s name, age, the year he or she first became a director and whether he or she has been determined to be an “independent director”, as that term is defined in Section 803A of the NYSE MKT Company Guide. Biographies of the director nominees follow the table. Unless otherwise indicated, all directors have been employed in their agescurrent positions for at least five years.

| Name | Age | Year First Elected Director | Term to Expire | Independent? | ||||||||||||

| W. Barry Gilbert | 65 | 1993 | 2013 | No | ||||||||||||

| Florence D. Hudson | 53 | 2012 | 2013 | Yes | ||||||||||||

| Edward W. Kay, Jr. | 57 | 2012 | 2013 | Yes | ||||||||||||

| Eben S. Moulton | 66 | 1992 | 2013 | Yes | ||||||||||||

| James C. Rowe | 64 | 2000 | 2013 | Yes | ||||||||||||

| Jerold L. Zimmerman | 65 | 2006 | 2013 | Yes | ||||||||||||

The following paragraphs provide additional information as of December 17, 2009,the date of this proxy statement about each nominee. The information presented includes information each director has given us about all positions they hold, their principal occupation and certain information about their business experience duringfor the past five years, and their directorshipsthe names of other publicly held corporations are set forth below.

W. Barry Gilbert, 63, has served as our chief executive officer since January 2004 and served as acting chief executive officer from June 2002 until that time. He has been a director of the Company since February 1993 and chairman of the board since February 2001. He is also an adjunct faculty member at the William E. Simon Graduate School of Business Administration at the University of Rochester. From 1991 until 1999, he was president of the Thermal Management Group of Bowthorpe Plc. (now known as Spirent Plc) of Crawley, West Sussex, England. Prior to that time he was corporate vice president and president, Analytical Products Division of Milton Roy Company, a manufacturer of analytical instrumentation. Mr. Gilbert has served on a number of charitable boards and advisory boards for privately-held companies. Mr. Gilbert received his B.S. degree in Accounting from Ohio State University and an M.B.A. degree from the University of Rochester. As our chairman of the board and chief executive officer, Mr. Gilbert provides our board with invaluable institutional knowledge of the operations of our Company, its markets, its customers and the industry in which it operates. He became our acting chief executive officer in June 2002 during a particularly challenging period for the Company. His extensive leadership, financial and management skills and his strategic initiatives contributed to the financial turnaround and growth the Company has experienced during his tenure as chief executive officer. Mr. Gilbert’s service with us, as well as his prior service as a senior executive officer of other public companies, provides him extensive knowledge of complex, strategic, operational, management, regulatory, financial, human resources and governance issues faced by a public company. This experience brings to our board important knowledge, expertise and insight related to strategic planning, business development, sales and marketing, corporate finance, mergers and acquisitions, human resources and investor relations.

Florence D. Hudson has been a director since August 2012. Ms. Hudson is a Director in Corporate Strategy at International Business Machines Corporation (IBM). She leads the development of business and technical growth strategies for IBM in areas such as energy & the environment, cloud computing, analytics, emerging markets, financing, hardware, software and services. Ms. Hudson has leadership skills in strategic planning, marketing, channels, partner development, sales and diversity programs, as well as technical experience in mechanical and aerospace engineering. Ms. Hudson has held a variety of leadership positions since joining IBM in 1981 including Vice President and Director of strategy and marketing developing new businesses, developing and executing growth strategies for current businesses, and serving industrial sector clients in aerospace, defense, electronics, automotive, chemical and petroleum industries. Prior to joining IBM, Ms. Hudson worked at Hewlett Packard in 1980-1981. She worked as an Aerospace Engineer at Grumman Corporation as a Grumman Scholar during the summers while in college in 1976 through 1978 and in 1979 at the NASA Jet Propulsion Laboratory. Her projects included U.S. defense aircraft programs, solar power satellites, the space shuttle and future missions around Jupiter. Ms. Hudson graduated from Princeton University with a Bachelor of Science degree in Mechanical and Aerospace Engineering in 1980, and has attended executive education at Harvard Business School and Columbia University. She has extensive not-for-profit Board experience including Special Director for Strategic Planning on the Board of Directors for the Society of Women Engineers, President of the Juvenile Law Education Project, and Vice President for SHORE which provides homes for homeless families. She currently serves as a Trustee for the Society of Women Engineers, is a member of the Princeton University Technology Advisory Council, and the Princeton University Advisory Council for the Department of Civil and Environmental Engineering. Ms. Hudson’s extensive leadership skills in strategy and business development, coupled with her leadership experience in Information Technology, and experience as an engineer in the Aerospace and Defense industry, provide the board with a unique blend of deep and broad business and technical insight in the business environment in which the Company operates.

Edward W. Kay, Jr., a director since November 2012, is a Certified Public Accountant who spent his 33-year career with PricewaterhouseCoopers LLP (PwC) working with companies in a wide variety of industries, including manufacturing, distribution, software and technology. During his tenure with PwC, he served in many capacities, including among others in the Accounting and SEC Services practice section of the Firm’s National Office in New York City, as leader of the firm’s technology practice in Dallas, Texas, as Managing Partner of the upstate New York practice, and, most recently, as Managing Partner, Rochester, New York Office from 1999-2012. He first joined PwC in 1979, and retired in June 2012. Mr. Kay earned a B.S. in Accounting from Duke University, and an M.B.A. in Finance degree from Northwestern University. Mr. Kay’s community involvement includes service as the Treasurer for the 2013 PGA Tournament at Oak Hill Country Club, Rochester, New York; President of Oak Hill Country Club, Rochester, New York from 2010-2012; Treasurer and Trustee of St. Bernard’s Institute, Rochester, New York; Audit Committee member, Roman

Catholic Diocese of Rochester, Rochester, New York; and Finance Committee member, Greater Rochester YMCA, Rochester, New York. During Mr. Kay’s tenure at PwC, he accumulated a wealth of experience in financial, securities, and business matters, including significant leadership roles in dealing with accounting and auditing matters related to public companies, which we expect will enable Mr. Kay to be a valuable contributor to our board.

Eben S. Moulton,, 63, a director since November 1992, has served as presidentmanaging partner of Seacoast Capital Corporation, Danvers, Massachusetts, ana private investment firm, since its inception in 1994 and served as president of Signal Capital Corporation, Danvers, Massachusetts, a financial services corporation, from 1988 until 1994. Mr. Moulton is a directorgeneral partner of Seacoast Capital Corporation and a director of Unitil Corporation, Hampton, New Hampshire, a utility company. He is also a director of several privately-held companies.

James C. Rowe,

Jerold L. Zimmerman

Corporate Governance and Board Matters

Corporate Governance Guidelines

Our business, property and affairs are managed under the direction of our board of directors. The board is committed to sound and effective corporate governance practices and, accordingly, has adopted Corporate Governance Guidelines that provide a system of best practices with respect to board function and communication. Our Corporate Governance Guidelines address matters including board composition, director responsibilities, director independence, selection of board nominees, board membership criteria, mandatory

retirement, meeting participation, executive sessions of our independent directors, evaluation of the performance of the chief executive officer, committees, succession planning, orientation and continuing education.

Director Independence

The listing requirements of the NYSE MKT require that a majority of the members of a listed company’s board of directors be independent. The rules provide that no director will qualify as “independent” unless the board affirmatively determines that the director has no relationship with the Company or any of its subsidiaries that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Based upon the NYSE MKT rules and applicable SEC rules and regulations, our board has determined that each of our directors is an independent director, other than Mr. Gilbert, who serves as our chief executive officer.

Board Leadership Structure

Our board is responsible for the selection of the chairman of the board and the chief executive officer. Our board does not require the separation of the offices of chairman of the board and the chief executive officer, and currently the positions of chairman and chief executive officer are held by the same person. The board believes that this is the most appropriate and suitable leadership structure for the Company at the present time because Mr. Gilbert, our chief executive officer, is the director most familiar with our business and industry and their challenges and is, therefore, best able to identify the strategic priorities to be discussed by the board. Mr. Gilbert is the direct link between senior management and the board, and provides critical insight and perspective to the board, as well as feedback to senior management through his thorough understanding of the issues at hand.

The board acknowledges, however, that independent board leadership is important and believes that the current structure provides independent board leadership and oversight while also benefiting from having Mr. Gilbert as chairman of the board. Six of our seven current directors, and five of the six nominees, qualify as independent directors, and each of the audit, compensation and nominating and governance committees is comprised solely of independent directors. Our independent directors meet in an executive session, without the presence of Mr. Gilbert, or any other member of management, at the conclusion of each board meeting. In addition, our independent directors have the ability to participate in the agenda setting process and have direct access to management. While the Board has not formally designated a lead director, generally either the chairman of the compensation committee or the chairman of the nominating and its Committees

Board Meetings and Attendance

During Fiscal 2009,2012, our board held fourseven in-person regular or telephonic meetings and acted three times by unanimous written consent. In addition, the directors considered Company matters and had frequent communication with the chairman of the board and others apart from the formal meetings.

During Fiscal 2009,2012, each incumbent director attended 100%at least 75% of the meetings of the board and theof those committees upon which such director served, held during the period that he or she served.

Director Attendance at Annual Meetings

We typically schedule a board of directors has determined that eachmeeting in conjunction with our annual meeting of stockholders and all directors are expected to attend the annual meeting. Each of our incumbent directors exceptattended the 2012 Annual Meeting of Stockholders (other than Ms. Hudson and Mr. Gilbert,Kay, who is an executive officerwere not yet members of the Company, is an "independent director" as such term is defined in Section 803Aour board of the NYSE Amex Company Guide and applicable Commission rules and regulations.

Board Committees

Our board reorganized its committee structure by separating the executive, nominating and governance committee into two committees – the nominating and governance committee and the executive committee. As a result, our board currently has established four standing committees:committees to assist in the discharge of its responsibilities: the audit committee, the compensation committee, the nominating and governance committee, and the executive committee.

Committee Membership

| Director: | Audit | Compensation | Nominating and Governance | Executive | ||||||||||||

| W. Barry Gilbert | — | — | — | Chair | ||||||||||||

| Florence D. Hudson | — | — | — | — | ||||||||||||

| Edward W. Kay, Jr. | — | — | — | — | ||||||||||||

| Eben S. Moulton | — | X | Chair | X | ||||||||||||

| James C. Rowe | Chair | — | X | X | ||||||||||||

| Amy L. Tait | X | — | — | — | ||||||||||||

| Jerold L. Zimmerman | X | Chair | — | — | ||||||||||||

Each committee acts pursuant to a written charter adopted by the board. The charter of each of the audit, compensation and nominating and governance committees complies with the NYSE MKT corporate governance requirements. There are no NYSE MKT requirements with respect to the charter of the executive committee. The committees regularly report their activities and actions to the full board at the next board meeting.

Theaudit committee

oversees our corporate accounting and financial reporting processes. It is responsible for the appointment, dismissal, compensation and oversight of our independent auditors, including the engagement of our auditors for the next fiscal year, the review with the independent auditors and approval of the plan of the auditing engagement, the review with the independent auditors of the results of their audit, the review of the scope and results of the evaluation of our procedures for internal auditing, the inquiry as to the adequacy of our internal accounting controls and our disclosure controls and procedures, the approval of audit and non-audit services to be provided to us by the independent auditors, and overseeing compliance matters for us. The audit committeeThecompensation committee oversees the development and administration of our executive compensation plans, reviews and approves the compensation for all executives other than the chief executive officer, reviews and recommends to the board the compensation of the chief executive officer, reviews and approves performance goals and objectives with respect to incentive plans for all executives, oversees the evaluation of the chief executive officer, reviews and recommends to the board the terms of any employment, severance, change in control, termination or retirement arrangements for all executives, and reviews and recommends to the board the compensation paid to directors. In addition, the compensation committee is responsible for reviewing and discussing with management the Compensation Discussion and Analysis that SEC rules require be included in our annual proxy statement and prepares the committee's report that the Commission rules require be included in our annual proxy statement. In Fiscal 2009,2012, the compensation committee held four meetings and acted twice by unanimous written consent.consent two times. The current members of the compensation committee are Messrs. SassanoDr. Zimmerman (Chairman), and Mr. Moulton, and Zimmerman, and each of whom has been determined by the board to be "independent"“independent” as defined in Section 803A of the NYSE AmexMKT LLC Company Guide. The compensation committee's

committee’s charter, which sets forth more specifically the duties and responsibilities of the committee, is available on our website atwww.iec-electronics.com. For more information on executive officer and director compensation and the role of the compensation committee, see "Compensation“Compensation of Named Executive Officers and Directors."

Thenominating and governance committee identifies and recommends to the board individuals to serve as directors and as nominees for election as directors of the Company and develops, recommends and reviews corporate governance principles applicable to the Company. In Fiscal 2009,2012, the nominating and governance committee met three times and acted by unanimous written consent two times. The current members of the committee are Messrs. Moulton (Chairman), and Rowe, and Sassano, each of whom is "independent"has been determined by the board to be “independent” as defined in Section 803A of the NYSE AmexMKT LLC Company Guide. The nominating and governance committee charter, which sets forth more specifically the duties and responsibilities of the committee, is available on our website atwww.iec-electronics.com.

Theexecutive committee exercises the powers of the board in the interval between regular meetings of the full board and reviews strategic planning matters. In Fiscal 2009, theThe executive committee did not formally meet but did communicate frequently with one another to discuss pending matters.hold any formal meetings during Fiscal 2012. The current members of the committee are Messrs. Gilbert (Chairman), Moulton and Rowe. Messrs. Moulton and Rowe each of whom, except for Mr. Gilbert, is "independent"have been determined by the board to be “independent” as defined in Section 803A of the NYSE AmexMKT LLC Company Guide. The executive committee charter, which sets forth more specifically the duties and responsibilities of the committee, is available on our website atwww.iec-electronics.com.

Nominating Process

The process followed by the nominating and governance committee to identify and evaluate candidates includes requests to board members, the chief executive officer, and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates and their qualifications, and interviews of selected candidates. The nominating and governance committee will consider director candidates recommended by stockholders. Nominations of persons for election to our board may be made at a meeting of stockholders only (i) by or at the direction of the boardboard; or (ii) by any stockholder who has complied with the notice procedures set forth in our bylaws and in the section entitled “Questions and Answers About This Proxy Material and Voting –— When are stockholder proposals due for next year’s annual meeting?”. In addition, stockholders who wish to recommend a prospective nominee for the nominating and governance committee’s consideration should submit the candidates’candidate’s name and qualifications toto: Corporate Secretary, IEC Electronics Corp., 105 Norton St.,Street, Newark, NYNew York 14513.

In evaluating the suitability of candidates to serve on the board of directors, including stockholder nominees, the nominating and governance committee seeks candidates who are independent pursuant to the NYSE AmexMKT independence standards and meet certain selection criteria established by the committee. The specific criteria required for the selection of each board member will be determined from time to time within the context of the current member composition of the board of directors and the evolving needs of the Company based on business strategy and current senior management competencies. The committee also considers an individual'sindividual’s skills, character and professional ethics, judgment, leadership experience, business experience and acumen, familiarity with relevant industry issues, and other relevant criteria that may contribute to our success. This evaluation is performed in light of the skill set and other characteristics that would most complement those of the current directors, including the diversity, maturity, skills and experience of the board as a whole.

Compensation Committee Interlocks and Insider Participation

During Fiscal 2012, Eben S. Moulton, Carl E. Sassano and Jerold L. Zimmerman served on our compensation committee. No member of our compensation committee: (1) was an officer or employee of the Company during Fiscal 2009;2012; (2) was formerly an officer of the Company; or (3) had any relationship requiring disclosure in this proxy statement as a related person transaction pursuant to CommissionSEC rules.

In addition, during Fiscal 2012 none of our executive officers served: (1) as a member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers serveserved on our compensation committee; (2) as a director of another entity, one of whose executive officers served on our

compensation committee; or (3) as a member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served as a director of our Company.

Risk Oversight

The board of directors is responsible for overseeing risks that could affect our Company and Related Matters

While our board committees are focused on these specific areas of risk, the full board retains responsibility for general oversight of risk. This responsibility is satisfied through reports from each committee chairman regarding the risk considerations within each committee’s area of expertise, as well as through reports from members of our senior management team responsible for oversight of material risk to the Company.

In addition, the full board focuses on the strategic, financial and execution risks associated with the annual operating plan, major litigation, acquisitions and senior management succession planning.

As part of its risk oversight responsibilities, our board of directors and its committees review the processes that senior management uses to manage our risk exposure. In doing so, the board and its committees monitor our overall risk function and senior management’s establishment of appropriate systems and processes for managing areas of material risk to our company, including, but not limited to, operational, financial, legal, regulatory and strategic risks.

Stock Ownership Guidelines

The board believes that it is important for directors to maintain an equity position in IEC to further align their interests with those of our stockholders and to demonstrate their commitment to the long term success of the Company. Our board established stock ownership guidelines for the directors that became effective on October 1, 2009. The guidelines require that the directors own, at a minimum, that number of shares of common stock with a value equal to three times the director’s annual board retainer ($24,000, for Fiscal 2012) within three years from the later of October 1, 2009 or the date the director was elected to the board. At October 1, 2012, the stock ownership requirement was 10,909 shares. Unexercised stock options (whether or not vested) do not count toward a director’s ownership for purposes of these guidelines. Currently, all the directors are in compliance with these guidelines.

Code of Ethics

We have a number of years, we have had a code of ethics for our employees, officers and directors. During Fiscal 2004, we adopted a revised version of our code of ethics, the Code of Business Conduct and Ethics, which applies to all of our directors, officers (including our chiefprincipal executive officer, chiefprincipal financial officer, principal accounting officer and other senior financialexecutive officers) and employees. In Fiscal 2004, weIt is a statement of the Company’s high standards for ethical behavior, legal compliance and financial disclosure. We also adoptedmaintain a whistleblower policy.

Availability of Corporate Governance Documents

We make available to the public variousa variety of corporate governance information on our website (www.iec-electronics.com)(www.iec-electronics.com) under “Investor Information –— Corporate Governance”. Information on our website includes our Code of Business Conduct and Ethics, Corporate Governance Guidelines, the Audit Committee Charter, the Compensation Committee Charter, the Nominating and Governance Committee Charter, the Executive Committee Charter, our Related Person Transactions Policy,Policies and Procedures, and our Whistleblower Policy.

Information regarding any amendmentsamendment to, or waiver from, the Code of Business Conduct and Ethics that applies to our principal executive officer, principal financial officer or principal accounting officer will also be posted onin that section of our website.

Communications with the Board of Directors

Stockholders and other parties may communicate directly with the board of directors or the relevant board member by addressing communications to:

[Name of director(s) or Board of Directors]

IEC Electronics Corp.

c/o Corporate Secretary

105 Norton Street

Newark,

All stockholder correspondence will be compiled by our corporate secretaryCorporate Secretary and forwarded as appropriate.

(PROPOSAL 2)

RATIFICATION OF THE SELECTION OF THE COMPANY'S

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL

The audit committee has selected the accounting firm of EFP Rotenberg, LLP to serve as the Company'sCompany’s independent registered public accounting firm for the fiscal year ending September 30, 2010.2013. EFP Rotenberg, LLP (and its predecessor, Rotenberg & Co., LLP) has served as the Company'sCompany’s independent registered public accounting firm since May 2002 and is considered by the audit committee, the board and management of the Company to be well qualified. The stockholders are being asked to ratify the audit committee'scommittee’s appointment of EFP Rotenberg, LLP. Stockholder ratification of the selection of EFP Rotenberg, LLP is not required by our by-laws or otherwise. However, the board is submitting the selection of our independent registered accounting firm to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify this appointment, the audit committee may, but is not required to, reconsider whether to retain that firm.EFP Rotenberg, LLP. Even if the appointment is ratified, the audit committee in its discretion may direct the appointment of a different accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders. A representative of EFP Rotenberg, LLP will be present at the annual meeting and will be given the opportunity to make a statement if he or she so desires and will be available to respond to appropriate questions.

Fees paid to EFP Rotenberg, LLP

The following table shows the fees that were billed by EFP Rotenberg, LLP for professional services rendered in Fiscal 2009 and Fiscal 2008.

| Fiscal 2009 | Fiscal 2008 | |||||||

| Audit Fees (1) | $ | 93,000 | $ | 66,500 | ||||

| Audit-Related Fees (2) | -0- | -0- | ||||||

| Tax Fees (3) | 7,500 | 5,000 | ||||||

| All Other Fees (4) | 7,500 | 43,588 | ||||||

| Total EFP Rotenberg, LLP Fees | $ | 108,000 | $ | 115,088 | ||||

| Description of Fees | Fiscal 2012 | Fiscal 2011 | ||||||

| Audit Fees(1) | $ | 144,000 | $ | 125,900 | ||||

| Audit-Related Fees(2) | — | 4,334 | ||||||

| Tax Fees(3) | 17,000 | 16,450 | ||||||

| All Other Fees(4) | 8,500 | 8,100 | ||||||

| TOTAL EFP Rotenberg, LLP Fees | $ | 169,500 | $ | 154,784 | ||||

| (1) | Audit fees primarily represent amounts billed for the audit of our annual consolidated financial statements for the respective fiscal years and the reviews of financial statements included in our Form 10-Q quarterly reports for each such fiscal year. |

| (2) | Audit-related fees represent consultations concerning financial accounting and reporting standards, as well as internal control. |

| (3) | Tax fees consist of professional services rendered by EFP Rotenberg, LLP primarily in connection with our tax compliance activities and the preparation of federal and state income tax returns. |

| (4) | All other fees in Fiscal 2012 and Fiscal 2011 are for audit services related to our 401(k) plan. |

Pre-Approval of Fees by Audit Committee

In accordance with applicable laws, rules and regulations, our audit committee charter and pre-approval policies established by the audit committee require that the audit committee review in advance and pre-approve all audit and permitted non-audit fees for services provided to us by our independent registered public accounting firm. The audit committee has pre-approved all services to be performed by, and all fees to be paid to, EFP Rotenberg, LLP in Fiscal 20092012 and Fiscal 2008.

Independence Analysis by Audit Committee

The audit committee has considered whether the provision of the services described above was compatible with maintaining the independence of EFP Rotenberg, LLP and determined that the provision of such servicesit was compatible with such firm'sthe firm’s independence. For each of Fiscal 20092012 and Fiscal 2008,2011, EFP Rotenberg, LLP provided no services other than those services described above.

Required Vote

The affirmative vote of the holders of a majority of the shares of Common Stockcommon stock present in person or represented by proxy at the Annual Meetingannual meeting and entitled to vote on the matter is needed to ratify the appointment of EFP Rotenberg, LLP as our independent registered public accounting firm for the fiscal year ending September 30, 2010.2013. Under Delaware law, an abstention will have the same legal effect as a vote against the ratification of EFP Rotenberg, LLP, and broker non-votes will have no effect on the outcome of the ratification of the independent registered public accounting firm.

Unless authority to so vote is withheld, the persons named in the proxy card intend to vote shares as to which proxies are received IN FAVOR OF approval of Directors unanimously recommend that the

THE AUDIT COMMITTEE AND OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMEND THAT THE STOCKHOLDERS VOTEFOR RATIFICATION OF THE APPOINTMENT OF EFP ROTENBERG, LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING SEPTEMBER 30, 2013.

AUDIT COMMITTEE REPORT1

Membership and Role of Audit Committee

The audit committee of our board is responsible for providing independent, objective oversight and review of our accounting functions, internal controls and financial reporting process. Currently, the audit committee is comprised of Messrs.Mr. Rowe, Sassano,Mrs. Tait and Dr. Zimmerman. The audit committee operates pursuant to a written charter adopted by the board of directors which was amended and restated in February 2009 and may be found on our public websitewww.iec-electronics.com under the heading of “Investor Information-Corporate Governance” section.Information” and subheading of “Corporate Governance.” We believe that each of the members of the audit committee is independent as defined by NYSE MKT rules and applicable lawsSEC rules and regulations.

Management has the primary responsibility for the financial statements and the reporting process, including our system of internal controls, and for the preparation of the consolidated financial statements in accordance with generally accepted accounting principles. Our independent accountants are responsible for performing an independent audit of those financial statements in accordance with generally accepted auditing standards and to issuefor issuing a report thereon. The audit committee’s responsibility is to monitor and oversee these processes on behalf of the board. The members of the audit committee are not professional accountants or auditors and their functions are not intended to duplicate or certify the activities of management andor the independent auditors.

Review of our Audited Financial Statements

In fulfilling its oversight responsibilities, the audit committee reviewed the audited financial statements in our Annual Report on Form 10-K for Fiscal 2012 with management and discussed the quality and acceptability of our accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in our financial statements.

The audit committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality and acceptability of our accounting principles and such other matters as are required to be discussed with the committee under generally accepted auditing standards, including the Statement on Auditing Standards No. 61 (Communications with Audit Committees). In addition, the audit committee has discussed with the independent auditors the auditors’ independence from management and us, including the matters in the written disclosures required by Independence Standards Board Standard No. 1 (Independent Discussions with Audit Committees), which were submitted to us, and considered the compatibility of non-audit services with the auditors’ independence.

| (1) | The material in this audit committee report is not deemed to be “soliciting material,” or to be “filed” with the Securities and Exchange Commission and is not to be incorporated by reference in any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filings. |

| Public Company Accounting Oversight Board in Rule 3200T. In addition, the audit committee has received the written disclosures and the letter from the independent auditors required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditors’ communications with the audit committee concerning independence, discussed with the independent auditors the auditors’ independence, and considered the compatibility of non-audit services with the auditors’ independence. |

The audit committee discussed with our independent auditors the overall scope and plans for their audit. The audit committee met with the independent auditors, with and without management present, to discuss the results of their examination, their evaluation of our internal controls, and the overall quality of our financial reporting.

In reliance on these reviews and discussions, the audit committee recommended to our board of directors (and our board has approved) that our audited financial statements for the fiscal year ended September 30, 20092012 be included in theour Annual Report on Form 10-K for the fiscal year ended September 30, 20092012 for filing with the Securities and Exchange Commission.

The audit committee selects the Company'sCompany’s independent registered public accounting firm annually and has submitted such selection for the fiscal year ending September 30, 20102013 for ratification by stockholders at the Company'sCompany’s annual meeting.

Audit Committee

James C. Rowe, Chairman

Amy L. Tait

Jerold L. Zimmerman

(PROPOSAL 3)

CONSIDERATION OF AN ADVISORY VOTE ON THE COMPENSATION PAID TO THE COMPANY’S NAMED EXECUTIVE OFFICERS

General

In accordance with Section 14A of the Securities Exchange Act of 1934, as amended, we are requesting stockholder approval of a non-binding advisory resolution approving the compensation paid to our named executive officers as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation tables and narrative discussion in this proxy statement under the caption “Compensation of Named Executive Officers and Directors” beginning on page 22 of this proxy statement. Proposal 4 below is a non-binding, advisory vote regarding the frequency with which we will conduct this non-binding, advisory vote.

The board of directors requests that stockholders approve the following advisory resolution:

RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the compensation tables and narrative discussion, is hereby APPROVED.

We believe that our compensation policies and procedures are effective in achieving IEC’s goals of rewarding sustained financial and operating performance and leadership excellence, aligning the executives’ long-term interests with those of our stockholders and motivating the executives to remain with the Company for long and productive careers. These policies and procedures are described below under the section “Compensation of Named Executive Officers and Directors”. The compensation committee of our board of directors, composed entirely of independent directors, in consultation with consultants from time to time, oversees our compensation programs and monitors policies to ensure that those policies are appropriate.

We urge stockholders to read the section entitled “Compensation of Executive Officers and Directors” beginning on page 22 of this proxy statement, including the 2012 Summary Compensation table and related tables and narrative included within that section, which provide detailed information on IEC’s compensation policies and practices and the compensation of our named executive officers. As discussed in greater detail in that section, our executive compensation program consists of four principal components: (1) base salary, (2) annual cash incentive compensation, (3) long-term equity compensation, and (4) perquisites and personal benefits. We believe that we have established reasonable base salaries as well as total compensation for our executive officers based on internal comparability and external market data, as well as individual responsibilities and performance. We believe that the cash bonuses paid under our annual incentive plan should and do reward the named executive officers for business and individual performance, encourage effective short-term performance while balancing that approach with a long-term focus, and provide a significant portion of total compensation opportunity that is at risk. We believe that awards granted under our long-term equity incentive plan give our named executive officers a meaningful equity stake in our business and encourage performance by our named executive officers that increases long-term stockholder return, and also serve as an effective tool in attracting and retaining experienced and skilled executive officers. The perquisites and personal benefits paid to our named executive officers are minimal.

Non-Binding Resolution

This advisory resolution, commonly referred to as a “say-on-pay” resolution, is not binding on the Company, the board of directors or the compensation committee of the board of directors, and may not be construed as overruling any decision made by the board. However, the board and the compensation committee will take the voting results into account when evaluating our executive compensation program and considering future compensation arrangements.

Required Vote

The affirmative vote of the holders of a majority of the shares of common stock present in person or represented by proxy at the annual meeting and entitled to vote on the matter is needed to approve the non-binding resolution approving the compensation paid to our named executive officers. Under Delaware law, an abstention will have the same legal effect as a vote against approval of this non-binding resolution, and broker non-votes will have no effect on the outcome of the vote.

Unless authority to so vote is withheld, the persons named in the proxy card intend to vote shares as to which proxies are received in favor of approval of the non-binding resolution approving the compensation paid to our named executive officers.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTEFOR THE APPROVAL OF THE COMPENSATION PAID TO OUR NAMED EXECUTIVE OFFICERS.

(PROPOSAL 4)

SELECTION OF THE FREQUENCY OF FUTURE ADVISORY VOTES ON

NAMED EXECUTIVE OFFICER COMPENSATION

General

In Proposal Number 3 above, we are asking stockholders to vote on an advisory resolution on executive compensation (the “say-on-pay” vote). Pursuant to Section 14A of the Exchange Act, in this Proposal Number 4 we are asking stockholders to vote on whether future say-on-pay votes should occur every year, every two years or every three years. You also may abstain from voting. Stockholders will have an opportunity to cast an advisory vote on the frequency of future say-on-pay votes at least every six years.

Our board of directors understands that there are different views as to what is an appropriate frequency for advisory votes on named executive officer compensation. After careful consideration, the board is recommending that future say-on-pay votes occur every year. We believe that this frequency is appropriate because it provides stockholders with an opportunity to express their opinion as to executive officer compensation as it may change from year to year.

Non-Binding Resolution

This advisory vote is non-binding on the Company, the board of directors or the compensation committee of the board of directors, and may not be construed as overruling any decision made by the board. However, the board and the compensation committee will consider the voting results on this proposal in determining the frequency of future say-on-pay votes.

Required Vote

Stockholders will be able to specify one of four choices for this proposal on the proxy card: one year, two years, three years, or abstain. The outcome of this vote will be determined by a plurality of the votes cast. This means that the frequency that receives the most affirmative votes will be the frequency approved by our stockholders.

Unless authority to so vote is withheld, the persons named in the proxy card intend to vote shares as to which proxies are received in favor of conducting an advisory vote on executive compensation EVERY YEAR.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR CONDUCTING AN ADVISORY VOTE ON EXECUTIVE COMPENSATION EVERY YEAR.

Named Executive Officers

This proxy statement contains information about the compensation paid to our namedchief executive officer, our chief financial officer, our two other most highly compensated executive officers (collectively, the “named executive officers”) during Fiscal 2009. For Fiscal 2009, we determined that the following officers were our named executive officers for purposes2012.

W. Barry Gilbert — Chairman and Chief Executive Officer

Jeffrey T. Schlarbaum — President

Vincent A. Leo — Chief Financial Officer

Donald S. Doody — Executive Vice President of this proxy statement:

General Information

The following discussion analyzesprovides a summary of our compensation policies and the compensation decisions formade with respect to our named executive officers. The focus of the discussion is on Fiscal 2009. However, when relevant, the discussion covers actions regarding compensation for our named executive officers that were taken after the conclusion of Fiscal 2009.

Objective of theOur Compensation Program

The goal of our executive compensation program is to support the attainment of our long and short-term strategic and financial objectives, thereby aligning the interests of the Company’s executives with the interests of shareholders.stockholders. Our executive compensation program is intended to provide a competitive program that enables us to attract, motivate, and retain the key executives required to enhance shareholderstockholder value.

The Company’s Approval and Decision Making Process

The Compensation Committee (“Committee”)compensation committee of theour board of directors (the “Committee”) approves and recommends to the full board all compensation decisions regarding our directors and chief executive officer and reviews and approves all compensation decisions regarding our other named executive officers. The Committee generally approves equity awards for the Company’s other employees, although the Committee from time to time has delegatedincluding by delegation to the Company’s chief executive officer the authority to award at his discretion up to a specified number of stock options or restricted shares to non-executive employees for special performance or recruitment to the Company. In Fiscal 2009, all2012, an aggregate of 57,200 options were granted to non-executive employees and new hires pursuant to such delegated authority, and an aggregate of 78,640 shares of restricted shares awarded to employeesstock were approvedissued by the Committee.

In order to maintain market competitiveness the Committee periodically reviews relevant competitive data provided by third party compensation professionals for the purpose of ensuring theunderstanding current compensation structure is designed to achieve the stated objectives.practices. In Fiscal 2008,2010, the CompanyCommittee engaged Grahall Partners LLC ("Grahall"(“Grahall”), a leading provider of compensation consulting services and survey data, to assist the Committee in reviewing total compensation for our named executive officers and other key employees.directors. Services included an executive compensation review and presentation of an overview of executive compensation trends and developments to the Committee ("2008 Report"(the “2010 Report”). During Fiscal 2010, the Committee also reviewed with Grahall certain information regarding director compensation. No further assessment regarding executive or director compensation was conducted by Grahall in Fiscal 2009.2011 as part of the Compensation Committee’s process in setting executive and director compensation for Fiscal 2012, however the Committee did take into account information contained in the 2010 Report. The Committee considered the comparative data provided in the 2010 Report as useful background information in understanding current compensation practices, but as only one factor in its assessment of appropriate compensation levels, policies and practices. It does not have a formal policy of “benchmarking” named executive officer compensation or director compensation against a certain percentile of the market data or using the market data to establish the level or mix of compensation. The Committee also considers factors described in more detail below in “Compensation of Our Named Executive Officers – Elements”. During Fiscal 2012, the Committee again engaged Grahall to assist the Committee in reviewing compensation for our executive officers and directors and establishing compensation for Fiscal 2013. The Committee selected Grahall because it is a leading provider of compensation consulting services and survey data, and was confirmed by the Committee to be independent.

Compensation of the Executives

The compensation program for the named executive officers consists of the following elements:

Annual cash incentive compensation;

Our named executive officers are also entitled to participate in a deferred compensation plan and a 401(k) savings plan, both described below.

The Committee has designed an executive compensation program consisting of these componentselements, which are intended to work together to provide a total compensation package that is described separately below.

creates a performance-based link between executive compensation and the attainment of financial, operational and strategic goals that we believe are critical drivers of sustained value creation over the long term;

Base Salary Compensation

Base salaries are used to provide a fixed amount of compensation for the named executive officer'sofficer’s regular work. The salaries of the named executive officers are reviewed on an annual basis, as well as at the time of promotion or other change in responsibilities. Salary ranges have been developed for each position using internal comparability, and external market data collected through Grahall. The ranges are based onGrahall, the responsibilities and scope of each position, and experience, skills and leadership capabilities required to perform each position.

For the named executive officers, other than the chief executive officer, the chief executive officer prepares a salary recommendation following a review of individual performance, competitive market data, and affordability for the Company. The recommendation is presented to the Committee. The Committee relies in part on the chief executive officer’s evaluation of each other named executive officer’s performance in deciding whether to make an adjustment to each executive’s salary in a given year. In the case of a change in role, careful consideration is given to the new responsibilities, externalinternal pay practices and internalexternal peer comparisons, in addition to past performance and experience.

Changes in the chief executive officer's base salary. In Fiscal 2009 the CEO’s salary was increased from $210,000 to $275,000. The board believed that the CEO’sChief Executive Officer’s compensation had been significantly below market basedare generally effective on the peer group survey information contained in the 2008 Report, particularly after taking into consideration the Company’s strong financial performance in Fiscal 2008. Therefore, it approved this increase to provide baseNovember 1 of each year, and compensation at a more competitive level.

to Mr. Schlarbaum, the Committee approved a one-time increase in base salary in the amount of $6,000. Messrs. Gilbert and Schlarbaum no longer receive a reimbursement of automobile-related expenses, and their base salaries will be reviewed and adjusted in accordance with the standard practices of the Committee and the board. The remainder of the increases were determined by the Committee based upon the factors discussed above, competitive conditions,including Fiscal 2011 performance. The increases became effective January 1, 2012 for Messrs. Doody and the Committee’s viewSchlarbaum, and November 1, 2011 for Mr. Gilbert.

Mr. Leo, who served as our interim chief financial officer from January 2, 2012 to May 23, 2012, and now serves as our chief financial officer, has during such entire period remained a principal and shareholder of each officer’s duties, responsibilitiesInsero & Company CPAs, P.C. (“Insero”), and performance.

Annual Cash Incentive Awards

Our named executive officers, other than Mr. Leo, may be awarded annual cash bonuses under our annual management incentive plan. The incentive plan (“for Fiscal 2012 (the “2012 MIP”). The MIP rewards executives and management for overall companyCompany performance with respect to increases in revenue and net income before tax,taxes and incentives, sales, and improved cash flow, and improvement in on-time delivery to our customers.flow. The incentive bonuses are generally granted based on a percentage of each named executive officer'sofficer’s base salary earned during the fiscal year. We believe this variable performance plan aligns the interests of our named executive officers with our shareholders'stockholders’ interest in improving the financial strength of the Company as it continues to grow.

The 2012 MIP links awards to performance results and is designed to provide cash incentive awards to the participating executive officers of the Company. For Fiscal 2012, the participants consisted of our chief executive officer (the “CEO”), our president, and our executive vice president of operations (“EVP”). Because Mr. Leo, our chief financial officer, is not an employee of the Company, he was not eligible to receive awards under the 2012 MIP. The 2012 MIP was finalized by the Committee on May 23, 2012.